Chancellor Kwasi Kwarteng has unveiled the biggest package of tax cuts in 50 years, as he hailed a “new era” for the UK economy.

Income tax and the stamp duty on home purchases will be cut and planned rises in business taxes have been scrapped.

Mr Kwarteng said a major change of direction was needed to kick start economic growth.

But Labour said it would not solve the cost of living crisis and was a “plan to reward the already wealthy”.

It comes as the Bank of England warns the UK may already be in recession.

The pound sank to a fresh 37-year low as the chancellor gave his statement.

In a departure from Boris Johnson’s economic policies, Mr Kwarteng has scrapped plans to push up taxes to pay for public services with the aim of boosting economic growth.

In a Commons statement, being dubbed a mini-budget, he said high tax rates “damage Britain’s competitiveness”, reducing the incentive to work and for businesses to invest.

He announced that the basic rate of income tax would be reduced by one percentage point to 19% in April – one year earlier than planned.

He also unveiled a cut to the top rate of income tax from 45% to 40%, meaning the UK will have a single higher rate from April.

Other measures include:

- The threshold people in England start paying stamp duty on home purchases will rise to £250,000

- For first-time buyers the threshold will rise to £425,000 and the value of the property they can claim relief will increase from £500,000 to £625,000

- Planned increases in the duty rates for beer, cider, wine and spirits will be axed

- The cap on bankers’ bonuses will be lifted

- New investment zones, where business will benefit from tax cuts and planning rules will be relaxed to encourage house building, will be established

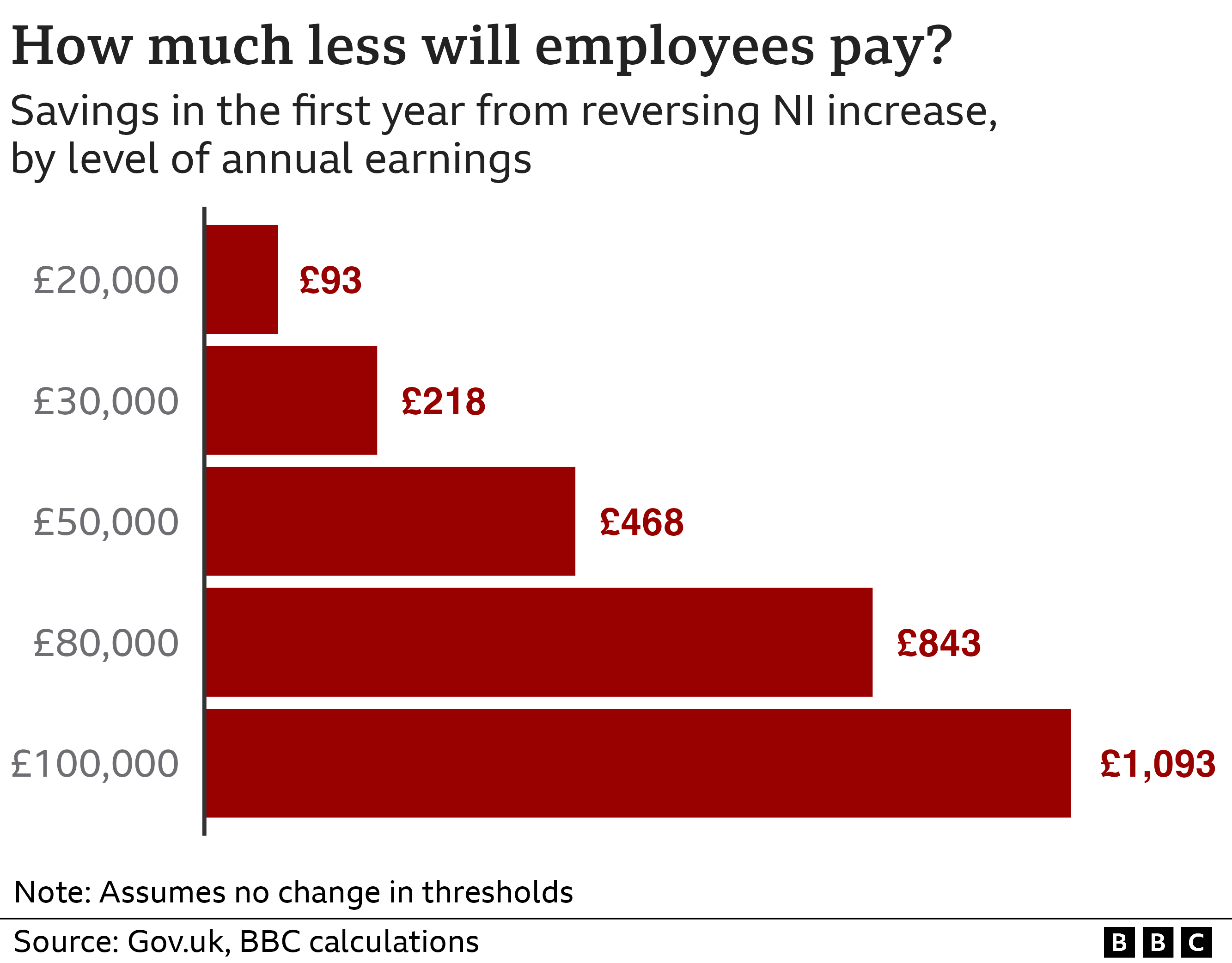

Mr Kwarteng fulfilled promises to reverse the rise in National Insurance payments introduced by Mr Johnson to pay for social care and tackle the NHS backlog

He confirmed a planned corporation tax increase from 19% to 25% would also be scrapped.

The total cost of the permanent tax cuts announced by the chancellor are estimated at almost £45bn by 2027, which the chancellor said would “turn the vicious cycle of stagnation into a virtuous cycle of growth”.

“We need a new approach for a new era, focused on growth,” he added.

Labour described his statement as “an admission of 12 years of economic failure”.

“The Conservatives cannot solve the cost-of-living crisis, the Conservatives are the cost-of-living crisis, and our country cannot afford them anymore,” shadow chancellor Rachel Reeves said.

“The chancellor has made clear who his priorities are today. Not a plan for growth. A plan to reward the already wealthy. A return to the trickle-down of the past. Back to the future, not a brave new era.”

The statement also included details of the cost of the government’s plan to cap energy bills for households and businesses.

Mr Kwarteng said these estimated costs were “particularly uncertain, given volatile energy prices” but based on recent prices the total cost of the package for the six months from October was expected to be around £60bn.

“We expect the cost to come down as we negotiate new, long term energy contracts with suppliers,” he added.

The government normally releases an independent forecast of how major tax changes will impact the economy, but Mr Kwarteng has opted not to do this, as his statement is not technically a Budget.

However, Mr Kwarteng promised the Office for Budget Responsibility would publish a full economic forecast before the end of the year, with a second to follow in the new year.

The independent Institute for Fiscal Studies think tank has described plans to ramp up borrowing to fund tax cuts as “a gamble on growth that may not pay off”.

The huge increase in borrowing comes at a time when inflation – the rate at which prices rise – is at a 40-year high, leading to higher interest payments.

On Thursday the Bank of England raised interest rates from 1.75% to 2.25% – the highest level for 14 years – in an attempt to cool soaring prices.

[This article is an adapted news story - the credits belongs to the original source article owner]

This post is adapted and was originally published on this site