- The UK’s biggest mortgage lender will raise rates on Wednesday as the cost of new fixed rate deals keeps climbing.

The Halifax, part of Lloyds Banking Group, will put up the interest rates on a range of deals for new borrowers to well over 5%.

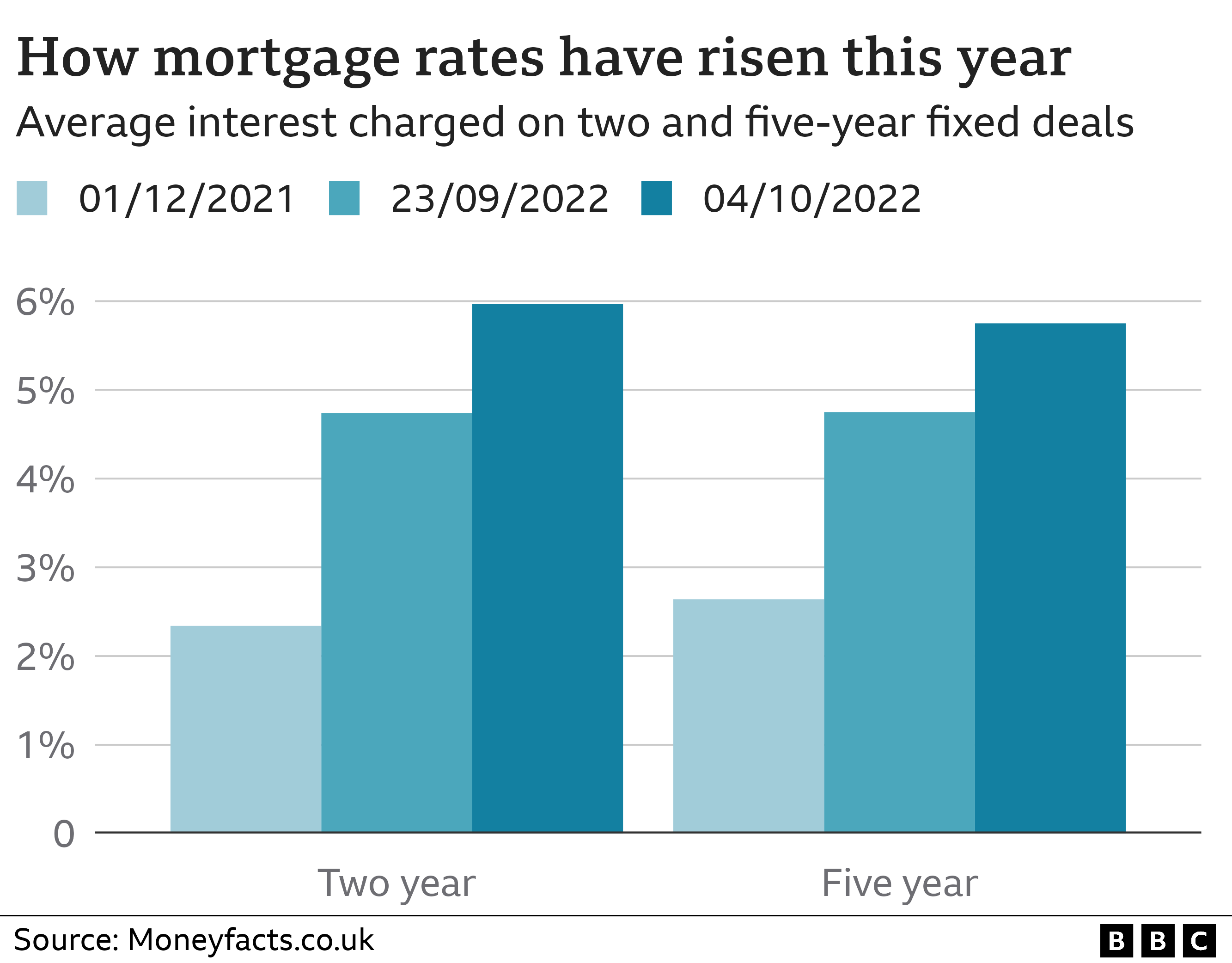

It follows a string of major providers in re-pricing products, which has pushed the average two-year fixed rate deal to 6%.

Four days ago, the rate was 5.43% and at the start of December it was 2.34%.

Brokers say lenders are “playing safe” with rates amid current economic uncertainty, but costs could eventually start to dip.

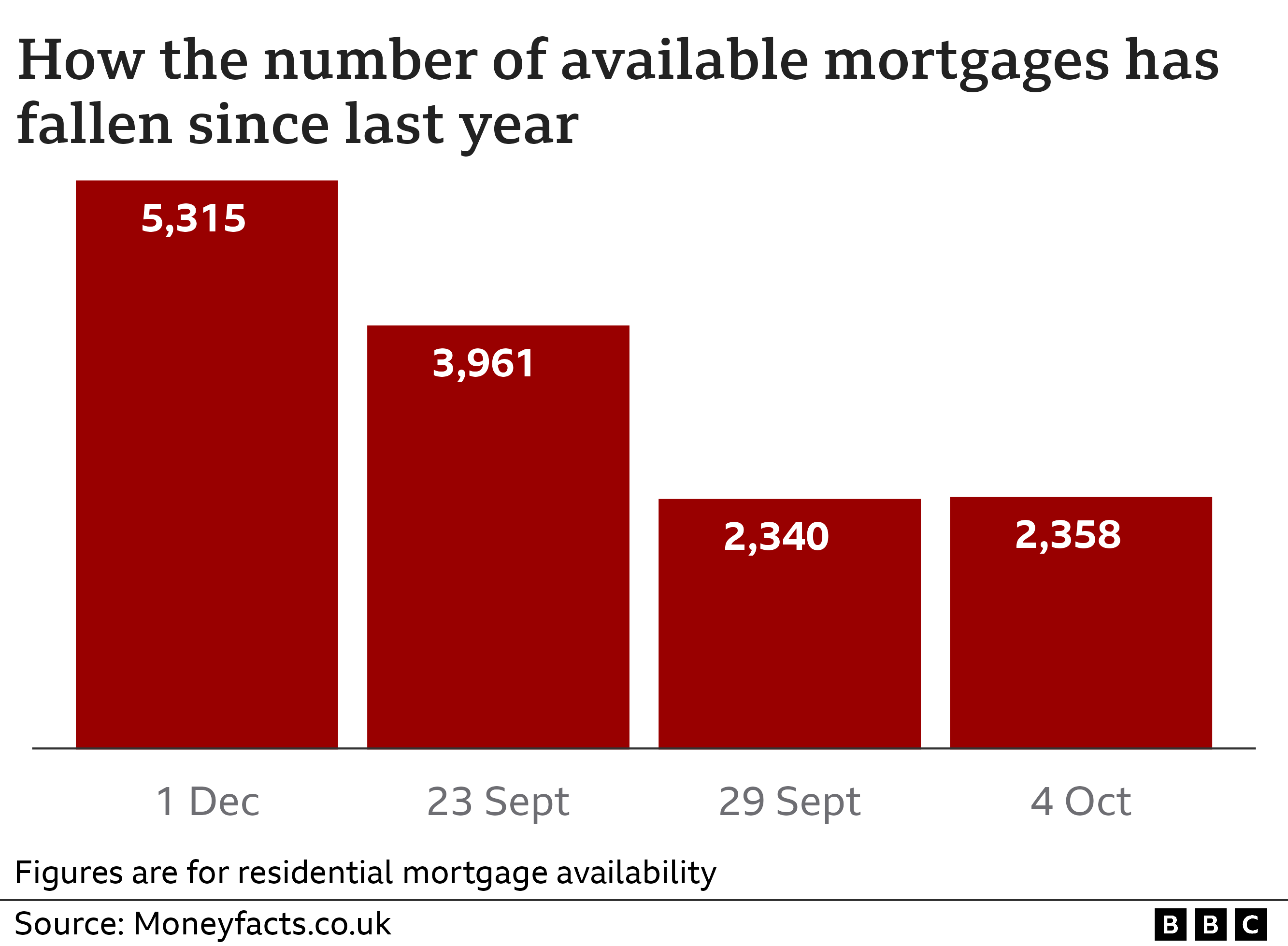

The fall-out from the mini-budget initially led to a slump in the value of the pound, as traders expected a sharper increase in interest rates by the Bank of England than previously anticipated.

That prompted mortgage providers to rapidly pull hundreds of deals from the market. This week, the availability of products has started to pick up again.

However, mortgages are now more expensive. That is affecting about 100,000 homeowners each month who remortgage and first-time buyers getting a new home loan.

The interest rate on a new, average two-year fixed deal has risen consistently since the mini-budget.

On the morning of the speech it was 4.74%. Now, it is 5.97%. A five-year fixed deal has typically risen from 4.75% to 5.75% over the same period.

In recent days, the biggest lenders have revised their prices.

On Wednesday, the largest of them – the Halifax – will increase its own. A spokesman said this was to “reflect the continued increase in mortgage market pricing over recent weeks”.

It means its rate for a two-year fixed deal for a customer offering a 25% deposit is up from 4.61% to 5.84%.

On a 30-year mortgage for somebody borrowing £200,000, that would mean a monthly repayment of £1,179 rather than £1,026.

‘Flight to quality’

Similar shocks to the mortgage sector in the past have led to lenders pursuing a “flight to quality”, according to Andrew Montlake, of mortgage broker Coreco.

That means lenders have concentrated their attention on borrowers able to offer large deposits and absolute certainty of repaying.

He said the current upheaval is likely to be a relatively short-term issue with lenders scrambling to reset prices, rather than a longer-term problem.

Lenders were playing safe with their rates, he added. Notably, the TSB has a stricter test of affordability – checking whether homeowners can cope were rates to rise to 8% (or 7% for first-time buyers) before accepting an application.

Some more specialist lenders, whose customers may include those with a chequered credit history or the recently self-employed, have been raising rates to 6.5-7% or more.

This group of customers may be the one that finds their choice of products is curtailed.

Mr Montlake said there was still high demand from borrowers, and money available for providers to lend.

Economic clarity provided by clear forecasts from the Office for Budget Responsibility should eventually feed through to stop the increase, or see some reversal in mortgage rates, he said.

The prospect has already improved the value of the pound.

Some brokers are worried that first-time buyers offering a 5% deposit could find it more difficult to find a deal.

“The 95% loan-to-value mortgage won’t die, but there will almost certainly be fewer of them due to the current economic situation,” said Ian Hewett, founder of Ashford-based The Bearded Mortgage Broker.

“Equally, I am sure they will be resurrected once stability is back and confidence in the government has resumed.”

[This article is an adapted news story - the credits belongs to the original source article owner]

This post is adapted and was originally published on this site